EACIPA viewpoint

From Depu to Guandan, in 2023, domestic investors changed their playing tables and made cautious moves

Create_time:2023-08-18 Views:372

Introduction: The rise of Guandan today is driven by the decline of US dollar funds and the rise of government guided funds, as well as the changes in the entire domestic private equity market chain in 2023.

There is a convention in the investment circle for social dinners. Before the meal, investors play cards together to pass the waiting time. If they are not fully satisfied after the meal, they play cards for another two to three hours. Investor Wang Yun, who is based in Zhejiang and focuses on the hard technology track, told reporters that this industry habit is still ongoing, but a detail change is that starting from mid to late 2022, the DePu at dinner parties and tables has been quietly replaced with "beaten eggs".

As a card game similar to De Pu, Guan Dan originated in the Jiangsu and Zhejiang regions. It is jokingly said that "if you don't beat the egg before a meal, it means you haven't eaten; if you beat the egg well, it means you have a mind; if you beat the egg well, it means you have a clear mind; if you calculate the egg carefully, it means you understand economics.". Wang Yun was also surrounded by more industry professionals who came to him for advice on how to play the game, as everyone's fundraising targets had changed.

Previously, Wu Shichun, the founder of Meihua Venture Capital, humorously joked about the changes in the industry during a talk show: "In the past, we raised funds to drink red wine, but now everything is white. In the past, we raised US dollars, but now we raise Chinese yuan. Going to Guandan, we also talk about investment attraction and anti investment."

In the heyday of US dollar funds, Depo penetrated almost every table of the private equity market, and now the rise of Guandan has become a new social tool in the investment circle. Behind this is the decline of US dollar funds and the rise of government guided funds, as well as the changes in the entire chain of the domestic private equity market in 2023.

RMB Fund Becomes Absolute Dominant

Entering August, the semi annual report of the private equity market is gradually being released. In 2023, which is considered a turning point, the private equity "fundraising, investment, management, and retirement" chain has all undergone changes.

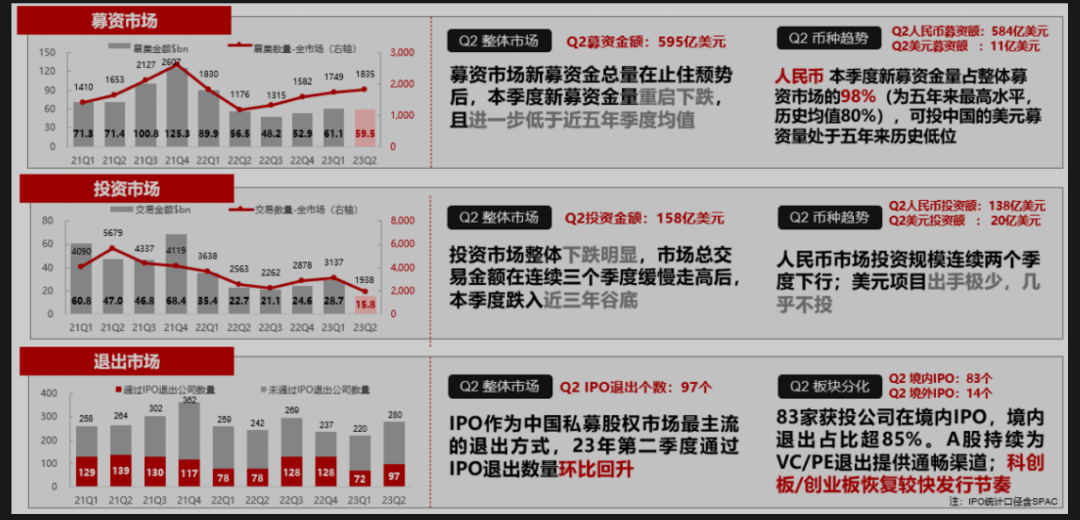

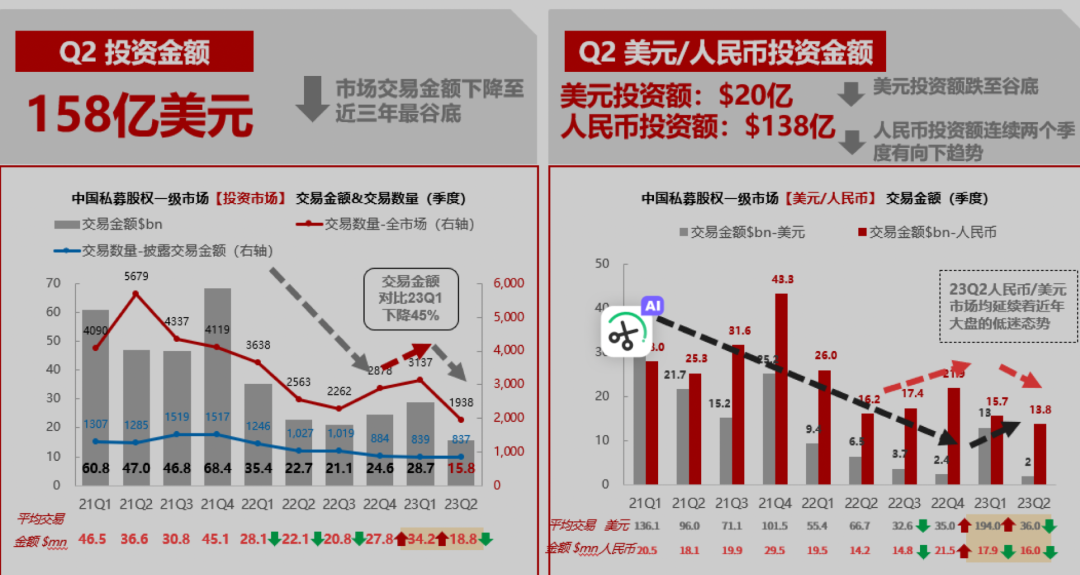

According to the Huaxing Research Report, in the second quarter of 2023, the amount of new funds raised in the quarter remained the same as the previous quarter and slightly declined, lower than the quarterly average of the past five years. The RMB fundraising market remained stable with an increase, accounting for 98% of the market. The fundraising in US dollars has almost come to a standstill; The overall decline in investment is significant, with a decrease in investment scale and project quantity. The investment scale of RMB funds has decreased for two consecutive quarters, while USD funds have hardly invested; The exit end has become the main focus of various institutions, with an increase in the number of companies exiting through different channels (listing, stock conversion, mergers and acquisitions, repurchase or liquidation), especially through stock conversion and repurchase liquidation. As a result, A-shares have resumed their normal issuance rhythm.

On the fundraising side, RMB funds have become the absolute dominant force. According to publicly available market data, the fundraising market added a total of 59.5 billion US dollars in the second quarter, which has fallen compared to the previous quarter and is lower than the historical average of 76 billion US dollars in the past five years; The RMB fundraising amount is 58.4 billion US dollars, with a steady increase for three consecutive quarters, and at the same time, it is 90% of the historical average for the past five quarters. In the second quarter, the fundraising amount in US dollars was only 1.1 billion US dollars, with almost no new US dollar funds raised. The fundraising amount in US dollars is 10% of the historical average of the past five quarters.

Huaxing Capital believes that in an environment full of opportunities and challenges, the market has become more pragmatic. Faced with pressure from the fundraising, investment, and exit ends, the equity investment market has a more obvious preference for investment opportunities with controllable risks and stable returns.

Yuan Wenda, founding and managing partner of Red Dot China, stated that when the first RMB fund was established in 2017, over 90% of LPs were market-oriented investment institutions, and the participation of local government guided funds and state-owned assets was very small. When preparing for the second RMB fund in 2020, the most frequent and frequent contact was with the local government guided fund.

Yang Xiaolei, CEO of Investment China Information, stated that currently in the domestic private equity market, state-owned assets and government guided funds are one of the few LPs with sustained investment capabilities. Observing the IRR (internal rate of return) of government guided fund investors can reveal a very interesting phenomenon - the risk preference of guided funds is significantly lower than that of financial investors. "This is a matter of mutual choice and causality," Yang Xiaolei said.

Yang Xiaolei, who continues to observe the private equity market in Beijing, said that anxiety is currently spreading. The first reason is that Beijing, as the political center, has a more intense external environment, and more people are willing to discuss politics; Secondly, there are too many US dollar GPs in Beijing, which used to be the biggest challenge, and this anxiety will be transmitted.

So, in the past few years, according to Yang Xiaolei's observation, a change in the industry has occurred. The efficiency of investment themes gathering in Beijing is not as strong, while Jiangsu, Guangdong, and Zhejiang have very fast growth rates. The further south you go, the less anxious you are. In Shenzhen, the RMB GPs are particularly relaxed, and the anxiety index is particularly low.

In May 2023, local governments and other state-owned institutions made frequent moves, with Zhejiang Province being particularly active. Science and technology innovation, manufacturing, semiconductors, and other fields are still the leading directions for fund investment.

According to investment data, in May 2023, based on regional distribution, the number of newly established funds in Zhejiang, Guangdong, Jiangsu, and Shandong provinces continued to lead, with Zhejiang slightly leading in terms of quantity, corresponding to 113, 107, 102, and 101 funds in sequence. Among them, multiple fund groups in Zhejiang Province were established in May: the "415X" Advanced Manufacturing Special Fund Group landed in Hangzhou; Hangzhou is upgrading and building three parent funds, namely Hangzhou Science and Technology Innovation Fund, Hangzhou Innovation Fund, and Hangzhou Mergers and Acquisitions Fund, to promote the formation of a "3+N" Hangzhou fund cluster with a total scale of over 300 billion yuan; Wenzhou has announced the establishment of a 100 billion yuan industrial fund cluster, a 50 billion yuan high-quality industrial development guidance fund at the municipal level, and plans to establish over 70 billion yuan industrial funds in various county (city) functional zones.

The rapid rise of state-owned assets and government guided funds is also directly reflected in the primary market. An entrepreneur who recently completed a new round of financing told reporters that theoretically, the style of US dollar funds is more radical. However, due to the low-key nature of US dollar funds and the rise of government guided funds in recent years, the slow pace of domestic entrepreneurship is clearly felt.

On the investment side, VC and hard technology are the main players

Whether it's the big model at the beginning of the year or the current room temperature superconductivity, there are not many discussions in the primary market and hype in the secondary market that have truly landed on the investment side.

In terms of the total investment and financing market, the investment and financing amount in the second quarter was 15.8 billion US dollars, a 45% decrease compared to the previous quarter, marking the lowest point since 2015. In terms of project quantity, this data has significantly decreased, with an average of 2500-3000 projects in a single quarter in history, and only 1938 projects in the entire market this quarter. In terms of currency types, the Chinese yuan has been declining for two consecutive quarters, while the US dollar has hardly made any moves.

Although the fundraising amount of RMB funds has increased, "caution" has become the theme word in the private equity market this year. Investment analysis suggests that the segmented reasons for the decline in investment quantity are due to the continued market downturn, difficulties in institutional exits, and cautious moves. In the overall environment, socio-economic growth is slowing down and the international situation is severe; The requirements of LP for GP are gradually increasing, special funds have become mainstream, and the professionalism of institutions in popular tracks is also constantly improving. The pressure on small and medium-sized institutions is increasing. With the increasing guidance of state-owned assets, many governments have vigorously promoted "early investment and small investment in technology" by issuing policies or setting up guidance funds to accelerate market recovery.

In the process of downsizing, "hard technology" and VC gradually become the protagonists. In the first half of 2023, the proportion of investment in the PE market, VC market, and early stage investment was 22%, 60%, and 18% respectively, which remained unchanged year-on-year. From the perspective of investment scale, the proportion of early and VC investment scale has increased again. In this period, the early investment scale has increased to 5%, and the total proportion of VC investment has reached 50%. It has become a consensus that early investment is small, and the market is gradually being occupied by VC, with institutional funds becoming increasingly dispersed.

In addition, among the investment targets, the pan technology track, including hard technology, advanced manufacturing, and new energy and new materials, has the largest concentration of funds, accounting for nearly 60% of the market share. The performance of the enterprise service track has rebounded, with an increase in transaction scale and project quantity, mainly relying on the support of major projects in this track, such as the A-round financing of the big language model Minimax, the D-round financing of Jitu Express invested by Sequoia Hillhouse, the B-round financing of Open Source China, and the D++round financing of Yunzhisheng, which has already been listed in the Hong Kong stock market; The consumer market has achieved the lowest financing amount in six quarters, with only one project with a financing amount of 100 million US dollars or more, for the B-round financing of Ruqi Chuxing led by GAC; The medical and health track still maintains the trend of the previous quarter, with a slight decline and no obvious signs of recovery.

Yang Xiaolei stated that the recent concentration of hard technology investment is too high, which will to some extent affect the ability to resist risks. Fortunately, the main focus is on VC actions, investing in the application layer rather than the basic innovation layer, making the overall cost controllable.

Comparing technological innovation with investment from China and the United States, Mi Qun, founding partner of Lightspeed Capital, stated that innovation always occurs through the alternation of hardware and software. In the Silicon Valley of the United States, hardware and chips were first established to establish their position, and then began to invest in consumer grade software, internet, and enterprise services.

Lightspeed has invested in Pinduoduo and Meituan in China, and started investing in hard technology ten years ago, both software and hardware. Mi Qun said that because this is an inevitable trend of innovation, there is now a differentiation - American VCs no longer invest in hardware, but in software, which is actually a great opportunity for China.

But there are also challenges that are still being overcome, why is innovation in artificial intelligence big models born in the United States? In Miqun's view, it is because many companies in the United States are willing to pay high software fees, and excellent software companies that are not profitable can still go public and have a good market value, but this is currently not possible in China.

The exit process of mergers and acquisitions still needs improvement

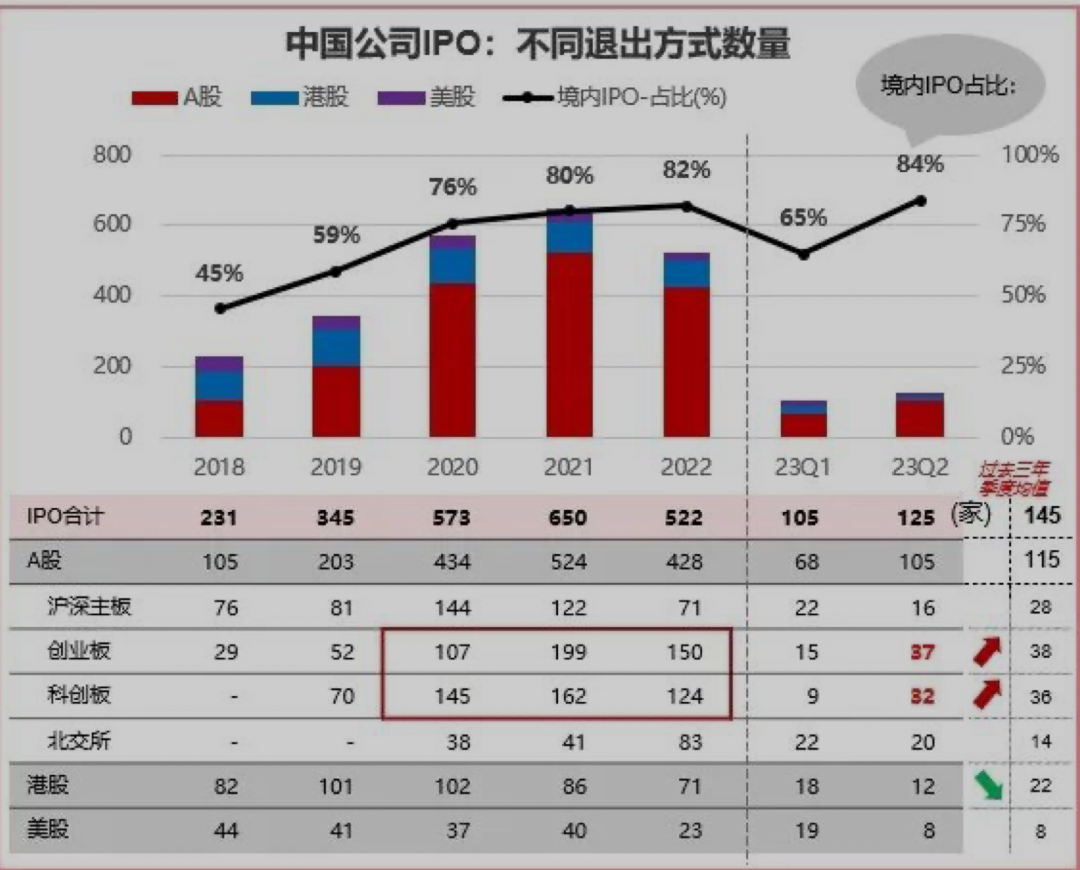

In 2023, the lively and intensive phenomenon of Hong Kong and US stock market listings will no longer recur, and exit has become an important issue of concern for market institutions in recent times. The so-called "exit" refers to the withdrawal of investors through IPO, mergers and acquisitions, stock transfers, repurchases, and liquidation methods.

Overall, the number of companies that withdrew in the second quarter has rebounded to 280 compared to the previous quarter, with a record high withdrawal rate of 14.4%. This to some extent reflects that "withdrawal issues" have become the focus of work for various institutions, and they hope to achieve revitalization through withdrawal.

In terms of specific methods, the number of companies that withdrew through "equity transfer and repurchase liquidation" significantly increased in the second quarter. IPO exit tests passive exit ability, while "stock conversion and repurchase liquidation" tests active exit ability. The proportion of IPO methods is gradually declining, from nearly 40% in 2021 to 33%. The significant increase in "stock conversion and repurchase liquidation" in the second quarter also indicates the urgency of various institutions for "exit".

According to Huaxing data, there were only 12 listed companies in the Hong Kong stock market in the second quarter, which is lower than the quarterly average of 22 companies in the past three years. The international subscription ratio for Hong Kong stock IPOs has continued to decline, with over 50% of Hong Kong listed companies breaking through on the first day in 2023. The fundraising volume of Chinese concept stock IPOs in the US stock market has returned to an extremely shrinking state. In the second quarter, there were only 8 listed companies in the US stock market, all of which were ultra small scale issuances by unknown companies, with issuance sizes below $15 million.

According to Lenovo Venture Capital President He Zhiqiang's observation, if we compare the exits in the investment markets of China and the United States, we will find a significant difference - over 50% of exits in the United States are through mergers and acquisitions, while China only has more than ten percent.

In He Zhiqiang's view, if Chinese enterprises want to truly achieve brand and high profit making, they must go through a unique strategic judgment and bet on future global innovation, and grow and strengthen through investment and mergers and acquisitions. At present, the development history of Chinese enterprises is relatively short, and mergers and acquisitions are relatively weak, making it difficult to achieve mergers and acquisitions of many small technology companies. This is the threshold that the entire Chinese enterprise and venture capital ecosystem must overcome in order to achieve healthy development, help Chinese enterprises grow, and enhance China's national strength. After crossing this threshold, the ecosystem of Chinese VC will make great progress.

Ma Jun, Managing Partner of Investment Capital, stated that the driving force for Chinese mergers and acquisitions will become stronger in the future. On the one hand, the proportion of IPOs exiting continues to decline, with an actual passing rate of only 52% in A-shares this year. The "exit from the barrier lake" is actually increasing, and the exit speed has not significantly accelerated due to the implementation of the registration system.

Secondly, Ma Jun believes that exiting the market is full of uncertainty, but LPs require real gold and silver returns, and focusing solely on IRR is difficult to meet LP requirements. The founder's mindset has also changed, not just considering selling the company. But it is difficult to reproduce the phenomenon of large-scale mergers and acquisitions by internet giants in the past.

In the past three years, we have seen the average transaction amount of mergers and acquisitions increase from 8 800 million yuan decreased to 520 million yuan. Generally speaking, listed companies are more comfortable with a merger and acquisition scale of 500 million to 600 million yuan, but when it comes to a scale of over 1 billion yuan, people are more afraid Ma Jun said.

Author | Lv Qian from First Financial