EACIPA viewpoint

Investor Zhang Jiahao: Seizing the Opportunities of China in the Post Pandemic Era, Interpreting "Five Dimensional Thinking" and "Three Laws"

Create_time:2022-12-26 Views:276

On December 6th, the Political Bureau of the Central Committee of the Communist Party of China held a meeting and set the main tone for economic work in 2023 as "stepping out of the epidemic, better coordinating epidemic prevention and control with economic and social development".

On December 7th, the Joint Prevention and Control Mechanism of the State Council issued the "New Ten Measures" for epidemic prevention and control, raising the requirements for epidemic prevention and control to be more scientific and precise, and minimizing the impact of the epidemic on economic and social development.

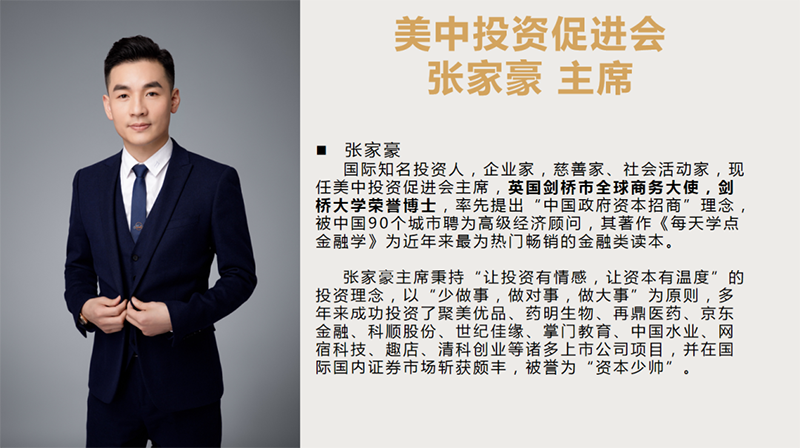

After the easing of the disturbance trend of the epidemic on macroeconomic operations, in the post epidemic era, the global economic environment is facing many uncertainties, and the financial investment market is full of variables. How to find new opportunities and discover certainty in the context of uncertainty has become a topic that many investors are thinking about. We interviewed Mr. Zhang Jiahao, an internationally renowned investor and chairman of the US China Investment Promotion Association.

Zhang Jiahao stated that since 2020, the global economic growth rate has significantly slowed down, and the fluctuation of the epidemic and the contraction of global liquidity have led to an increase in the risk of stagflation. The trend of global asset prices has also experienced significant fluctuations, and the global risk assets and stock markets have generally declined. In terms of commodities, affected by the Russia-Ukraine conflict, geopolitics and supply chain security, the price of crude oil also rose significantly, and agricultural products also had a great upward pressure, which also increased the pressure of core inflation.

With the gradual relaxation of prevention and control policies in various countries, the global economy is accelerating its return to a normal track. Zhang Jiahao believes that in the post pandemic period, the recovery rate of commercial investment is faster than the pace of global economic growth, and it is more significant during the downturn. Capital serves society, while investment serves development. He proposed to make investment emotional and capital warm, with each investment based on enhancing industrial value and promoting economic development. Therefore, Zhang Jiahao pointed out that commercial investment can drive long-term economic recovery. If capital is invested in the field of technology, overall productivity can be further improved, allowing strong growth to continue.

Zhang Jiahao adheres to the investment philosophy of "capital as the core, industry as the foundation, and integrated operation as the guidance". Years of industrial accumulation have enabled him to discover and seize more investment opportunities from a global perspective. In his years of investment career, he has invested in various fields including Pharmaceuticals, Zaiding Pharmaceutical, JD.com Finance, Keshun Shares, Century Jiayuan, Zhangmen Education, China Water Industry, Wangsu Technology, Qudian Many listed company projects such as Qingke Entrepreneurship.

From the selection of industrial tracks to multi-dimensional entry into the industry, and then to comprehensive operational improvement and deep collaboration, through the three wheel drive of "capital empowerment+industrial investment+integrated operation", we efficiently integrate the industrial chain and promote the steady growth of invested enterprises.

Regarding the key tracks and industrial trends of China's future economic development, Zhang Jiahao stated that the 20th National Congress report profoundly outlines the future policy agenda and economic and social development blueprint. From the perspective of industrial direction, the national industrial layout is concentrated in cutting-edge directions such as intelligence, low-carbon, and health. The report of the 20th National Congress also emphasized the goal of cultivating new economic growth engines in fields such as information technology, artificial intelligence, biotechnology, new energy, new materials, high-end equipment, and environmental protection. This indicates that in the future, the country will focus on policies, funding, talent, technology, and other factors in these areas from top to bottom, and institutional advantages will be revealed, which means there are huge industrial investment opportunities hidden.

Regarding investment, Zhang Jiahao believes that capital flow should be subordinate to the overall goal of economic development and transformation. If the 20th National Congress of the Communist Party of China clarifies the overall direction of economic policies for the next five years, targeted policies will be introduced next. The implementation of each major industry policy will release trillions of market dividends, which is equivalent to indicating the direction of future resource and capital flow.

The key lies in how to interpret policies and predict trends.

Regarding this, Zhang Jiahao has his own unique system. Zhang Jiahao stated that "Five dimensional thinking - human nature thinking, social thinking, political thinking, industrial thinking, and financial thinking" is an action guide that runs through investment behavior. For this reason, Zhang Jiahao requires his team of executives to deeply study the work reports of each government, pay attention to the latest central policies, and establish rules such as resolutely not investing in monopolistic livelihood and education projects. Based on the guidance of the five dimensional thinking, Zhang Jiahao actively promotes the transformation and landing of global financial capital, advantageous technologies, and advanced industries in China, with capital, projects, and talents as the core advantages, Assisting in the transformation and upgrading of local industries in China, as well as attracting investment and intelligence, it has created a series of new era urban business cards for China on the world stage, and is spreading the voice of China's positive energy development to the outside world.

In Zhang Jiahao's book "Learning Finance Every Day", he further elaborated on the "three principles" of commercial investment based on the five dimensional thinking - policy, trend, and people. Based on the precise control and scientific prediction of the three elements of "policy, trend and people", Zhang Jiahao has repeatedly made big investments in the international and domestic secondary markets, successfully investing in Kweichow Moutai, Dawn, BGI, Zijin Mining, BYD, BOE, Ningde Times, Apple, New Oriental, Tesla, Amazon, Nvidia and other companies, with an average return on investment of more than 200%.

Especially at the beginning of 2020, when the epidemic had just erupted, Zhang Jiahao made a large purchase of Dawn shares and decisively filled his position when New Oriental fell to one dollar. These were excellent investments made by Zhang Jiahao based on his understanding of five dimensional thinking and precise judgment of policies, trends, and people.

Regarding the development of future trends in the secondary market, Zhang Jiahao stated that it has been 15 years since the Shanghai Composite Index first broke through 3000 points in 2007, but the index still fluctuates around 3000 points, causing various jokes to fly in the sky. "3000 point defense war" has become a black humor for investors.

Looking back at the five 3000 point defense battles in history, they lasted for as long as nearly two years and as short as nearly two months. Overall, the 3000 point defense battle in history often presented itself as a tug of war, or even a protracted battle. Zhang Jiahao found that if calculated based on the annual closing price, the last time the Shanghai Composite Index closed below 2000 points was at the end of 2008, and below 3000 points was at the end of 2018. In the long run, the bottom is still gradually rising.

From a historical perspective, there is a high probability that there will be a period of adjustment around 3000 points, and after a complete correction, there is often a significant upward trend. After falling below the psychological defense line and integer threshold, the market usually spreads panic, which is a good time for investment layout. Zhang Jiahao pointed out that we should always maintain a market sensitivity of "others fear me and I am greedy, others fear me and I am greedy".

In the interview, Zhang Jiahao had a positive and optimistic view on the future trend of A-shares. On the one hand, in the post epidemic period, the Chinese economy needs policy stimulation and revitalization, and economic recovery will drive a new wave of market trends in the financial market. On the other hand, in order to achieve the long-term goal of building a socialist modernized strong country, a series of industrial support policies will be intensively introduced after the 20th National Congress, and the basic situation of each sector will perform well under the policy dividend, with the potential for sustained growth.

As mentioned earlier, "policies and trends" are two major investment factors, and another element is "people". Yu Minhong and New Oriental are typical cases.

As a leading enterprise in the K12 track, New Oriental suffered the most severe blow in the double reduction policy. Surprisingly, just one year later, New Oriental emerged from its low point. On the evening of October 26th, New Oriental released its unaudited performance for Q1 of the 2023 fiscal year. During the reporting period, New Oriental's net revenue was 745 million US dollars, a year-on-year decrease of 43.1%, and operating profit was 78 million US dollars, a year-on-year increase of 140.5%. New Oriental's shareholders should account for 66 million US dollars in net profit, a year-on-year increase of 9.0%. Affected by this news, New Oriental's stock price surged 28.3% on the same day after the opening of the US stock market.

Zhang Jiahao said, "The decline in revenue of New Oriental was expected, mainly to comply with relevant policies and the impact of terminating the K9 subject after-school tutoring business, which led to a decrease in revenue. New Oriental's stock price had already plummeted by more than 90% at that time, so the negative impact of this event had long been digested by the market."

However, while revenue has significantly decreased year-on-year, with the closure of more than half of heavy asset projects such as learning and learning centers, New Oriental's operating costs have also significantly decreased. In addition, the profit margin of the light asset e-commerce live streaming industry is far higher than that of the overweight asset education industry. New Oriental's live streaming business has shown impressive performance and may have already accounted for half of the profits.

Zhang Jiahao greatly appreciates Yu Minhong's entrepreneurial spirit. He was able to face this setback in his golden age and personally practice what he said, "finding hope in despair." Praising him as an unbreakable entrepreneur is not an excessive praise. The leadership philosophy demonstrated in him ensures that the enterprise develops in the right direction, enhances cohesion, unleashes employee creativity, and brings greater benefits to the enterprise.

At the beginning of 2022, Zhang Jiahao judged that New Oriental had a successful business philosophy and team, while Yu Minhong had all the necessary elements for success. All that was needed was a transformation of the business model. Therefore, when New Oriental's stock price fell to $1, he fully invested and entered, with a current investment return rate of up to 2000%.

At the end of the interview, Zhang Jiahao said: Many times, successful investments are not due to strong abilities, but happen to catch the train of national transportation. Where does the national fortune come from? In addition to being driven towards the right direction (trend) by the policy of one stop after another, it also requires an interpretation of the current situation and advanced predictive ability. We only need to bet on the right person at the right time. Opportunities always belong to prepared long-term optimists, making us believe in value, invest heavily in China, and be friends with time!

- Prev:Sail to the Stars and Seas with the Vast East Wind--US-China Investment Promotion Association's New Year Message for 2023

- Next:The United States China Investment Promotion Association organized members to watch the grand opening ceremony of the 20th National Congress of the Communist Party of China, with the concept of equality, openness, and cooperation to build a new type of international relations and promote high-quality development